I am a greedy guy. Typically when I learn something, it’s so I can make money. My favorite way to make money? Investing. When it comes to assessing a potential investment. I thought price was the most important thing to know… Until I learned about Market Capitalization.

What is Market Capitalization?

Commonly known as market cap, market capitalization is the total market value of an asset. In the stock market it is fairly easy to calculate.

Number of Shares X Price of Share = Market Cap

For example: at the time of writing Tesla’s market cap is 900 billion. There are 1 billions shares issued currently worth 900 dollars a piece. Simple enough.

Crypto Market Caps can be a little more complicated. Depending on a crypto’s ability to be mined, tokens being locked or burned, and other reasons, it is important to look at two market caps.

- Market Cap

- Current amount of circulating coins multiplied by the current price

- Fully Diluted Market Cap

- Total amount of coins that will be mined or unlocked (minus burned coins) multiplied by the current price.

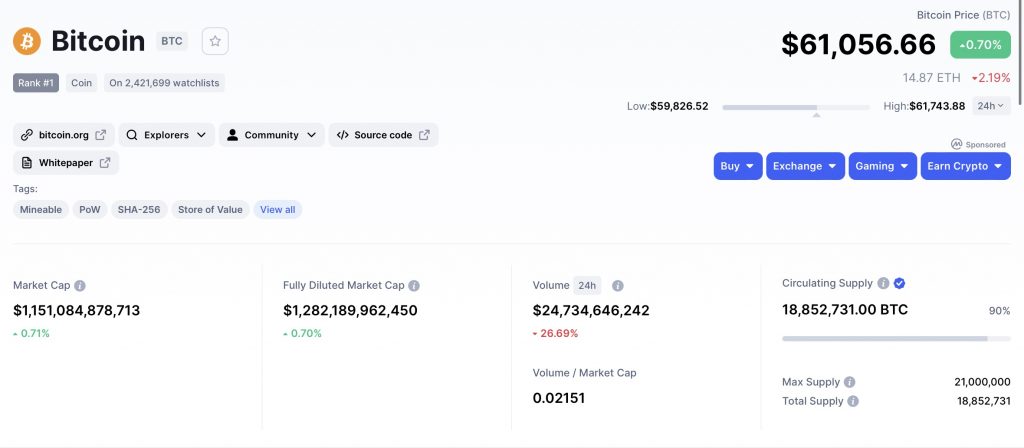

Using bitcoin and the image above as reference, we see that the current market cap is 1.15 Trillion. That is calculated by the Current Circulating Supply of 18.85 million coins priced at $61k a piece.

The fully diluted market cap is over 100 billion dollars higher because we have over 2 million coins left to be mined.

Why is Market Capitalization Important?

I find knowing the market cap of a potential investment to be very helpful. In just the one number, I can tell how much investors think a company or blockchain technology is worth. Price alone tells me almost nothing, the same for number of shares. Apple shares cost a mere $148 right now, while tesla costs $900. If I had to base my investment off this knowledge alone, I would think that Tesla was 6x as big as Apple. This is not the case because there are 16.53 Billion Apple shares making it’s market cap 2.46 Trillion.

Market Cap also helps (not guarantee) determine the risk of an investment. The higher the market cap the more trust investors have in the asset. This typically means a safer investment.

Lower market cap assets are way higher risk and often times not as regulated. This is where you can find a lot of cryptos and penny stocks.

Market Capitalization has many important uses, these are Just Enough To Get U In Trouble.

Check back in to the site as I plan to go into more depth on using market cap to assess crypto specific investments, and red flags to be aware of.

If I can understand something, so can you.

Thanks for the post!

Thank you!